This is the information you wish your parents would have taught you!

This is a course for grown-ups who intend to be actively teaching their kids how to live a healthy financial life, but who had not been given the tools themselves...until now!

This course is divided into four phases. After covering our foundation, we start our journey at the teenage years and work backward to cover all the mechanics of financial literacy as they are age-appropriate. Even if your kids are still toddlers, start at the videos for the teenage years and work backwards!

Foundation

First we cover how can we help our children to find innovative ways to make money, save it wisely and spend it generously. We'll also look at how to best allocate the money they earn.

Teenagers

When you are teaching your teens about money, they need to know they have the power to make decisions, as well as basic financial knowledge like the difference between income and expenses.

Pre-Teens

Here we'll look at the correlation between understanding money and financial freedom. Compound interest and making smart spending - and budgeting - decisions are key lessons.

Kids

This is a great age to allow kids to start making financial choices. We also talk about goal-setting & delayed gratification as part of the financial management process for kids this age.

It's never too early to start!

Meet your kids where they are and start the conversation around money, today.

Video content to help you best learn how to talk to your kids about money

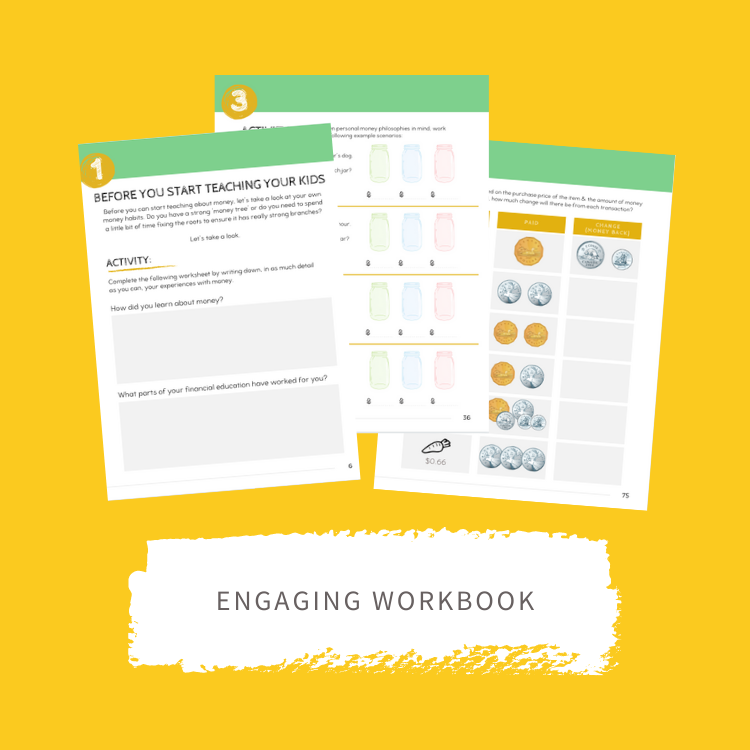

Full-color downloadable workbook to get clear on your parenting philosophies around money

Social media support in our community of intentional parents

Set Your Kids Up for Financial Success.

It is never too early to learn the fundamentals of smart saving and savvy spending. How to Teach Your Kids About Money tackles tough financial concepts in an approachable and, dare we say, fun way with lots of hands-on exercises and fun projects for parents & kiddos to do together.