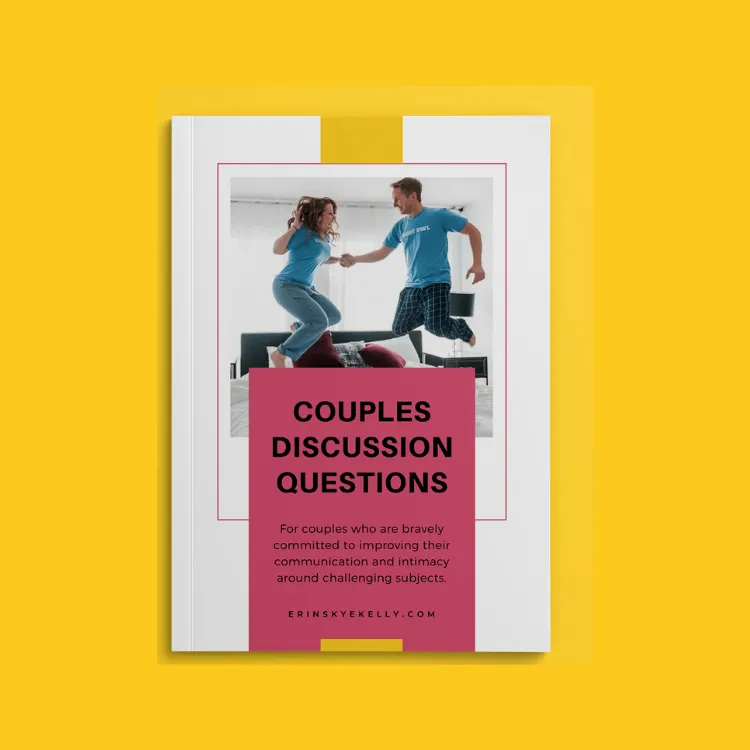

My life’s mission is about removing the shame and frustration of finances and empowering you to make money decisions you are proud of.

WORK WITH ME

AS SEEN IN:

I’m not a woman who will tell you to cut out every personal luxury always and forever.

I don’t believe avocado smash toast is the reason you are broke. I also do not cut coupons like it is an extreme sport.

As far as I can tell, we’ve got one shot at this life, and frankly, I do want you to actually live it. But I don’t want you to spend the next 20 years of your life paying for decisions you made 10 years ago.

Years ago, I owned a mortgage brokerage, and I met many financial professionals: realtors, financial planners, insurance experts, bankers, accountants…even other mortgage brokers who were struggling with debt. The very experts we are taught to turn to for financial advice were living paycheck to paycheck and consolidating their own consumer debt so they could survive. They would call me in hushed shameful voices asking for desperate help, and it broke my heart. Mostly because I knew all-too-well about financial shame myself.

Because of all of this, I set out on a mission to free people from consumer debt. I don’t do it with any fancy math or software. There is no consolidation or equity-take out or remortgaging. Basically, I do not believe in paying debt with debt.

I walk you through a proven 3-phase process of financial education and literacy and you make it happen. You don’t need a consolidation loan to fix this mess. You don’t even need to necessarily be good at math. This process eliminates financial stress and allows you to break the cycle of broke.

Everything you have is within you and I’m just here to help you see it.

If you have ever felt stress about money, lost sleep because of money, beat yourself up because of money decisions, or felt stuck and hopeless because of money, we just became best friends.

I know you can change your life by determining where your money is going, and understanding your financial picture, no matter your current situation.

How do I know this?

I was once $2.1 Million Dollars in debt. I know that number sounds astronomical, and it is. It was. It wasn't like I woke up one day and decided "hey, I'm going to take out a schwack of debt I can't afford." It happened the way it happens to you - dollar by dollar, decision by decision. After I had tried consolidating and refinancing and about 4 other 'quick-fixes' I learned that I had better just educate myself and truly understand how money works.

And now I teach other people how to pay off debt and build wealth with tremendous success. My average reader becomes completely consumer debt free in 1-2 years simply by financial education and following a system that helps them take control of their dollars, rather than allowing their debt to control them.